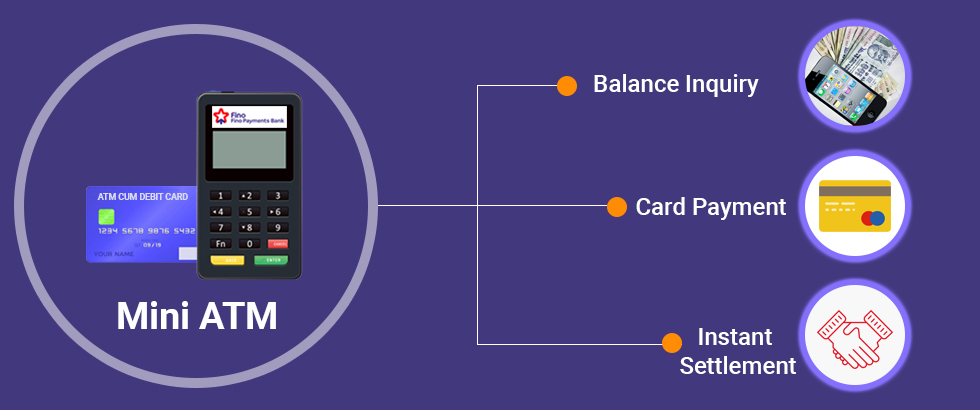

Mini ATM typically refers to a device or service that allows individuals to perform basic banking transactions, such as cash withdrawals and balance inquiries, without the need for visiting a physical bank branch. These devices are often found in various retail establishments, and they are used to provide basic banking services to customers. Customers can check their account balances to see how much money they have in their accounts.

In locations where bank ATMs are sparse and far between, Pentabit micro ATMs are useful. Customers now have easier access to cash withdrawal, particularly in rural and Tier 2,3 locations. Thousands of Indian retailers are experiencing incremental increase in their income and business as a result of employing our micro ATM services.

Commission On Every Transaction

Instant Settlement

Accepts All Debit Cards

1 Yrs Device Warranty

Hybrid Device - Mini ATM & MPOS

Dedicated Customer Service Team

Best In Industry Sales Support

In locations where bank ATMs are sparse and far between, Pentabit micro ATMs are useful. Customers now have easier access to cash withdrawal, particularly in rural and Tier 2,3 locations. Thousands of Indian retailers are experiencing incremental increase in their income and business as a result of employing our micro ATM services.

Find an ATM: Find a local ATM that is a part of your bank's network or one with which it has a partnership. Bank branches, standalone kiosks, shopping malls, and other public locations frequently have ATMs. Put Your ATM Card In: Put your debit or ATM card in the ATM's card slot. Make sure the card's magnetic stripe or chip is facing the machine in the appropriate orientation. Specify Your PIN: Your Personal Identification Number (PIN), which is commonly a four- to six-digit code, will be requested by the ATM. Enter your PIN using the machine's keypad. To shield your PIN from prying eyes, cover the keyboard. Choosing Your Transaction: The ATM will display your PIN once you have entered it.

I utilize the services of Digital Sevakendra Mini ATM. My consumer base increased when I installed the ATM signs that Pentabit provides. More clients mean more revenue.

Good commission is provided by the mini ATM service. Additionally, this Pentabit Mini ATM device is incredibly sturdy and has a 2-year warranty.

The services of Pentabit. My consumer base increased when I installed the ATM signs that Digital Seva Kendra provides. More clients mean more revenue.

Mobile devices have two primary options for internet connectivity: using cellular data or connecting to a Wi-Fi network, which can be either private or public. In general, using cellular data is considered the most secure method for internet access, while connecting to a private Wi-Fi network is the next best option, and using a public network is typically the least secure choice.

Avoid using unsecured Wi-Fi networks for banking, making purchases, or accessing your email. It can be challenging to determine the security of public hotspots in places like these, so it's advisable to refrain from using them. OPT for a 3G or 4G mobile internet connection, even if it might be slower. Your security is worth it.

Not only is the app user-friendly, making it accessible even for those not well-versed in technology, but it also boasts a high level of security. Citi employs a multi-layered security approach, including biometrics, to ensure the safety of your information. Additionally, you have the option to configure alerts that will notify you of any suspicious activities on your account.